To make the best portfolio decisions, banks need to accurately calculate values of their trades, while factoring in uncertain external risks. This requires high-performance computing power to run complex derivatives models — which find fair prices for financial contracts — as close to real time as possible.

“You don’t want to trade today on yesterday’s data. You want to have up-to-the-moment portfolio values under many possible scenarios,” said Ryan Ferguson, CEO of Riskfuel, a Toronto-based startup that has built an AI-based accelerator technology for valuation and risk workloads.

Ferguson used to run securitization and credit derivatives for Scotiabank Global Banking and Markets. He noticed this industry-wide challenge and shifted his career to help address it, founding Riskfuel in 2019.

The company trains and develops its AI models using NVIDIA DGX systems, NVIDIA GPUs and the NVIDIA CUDA parallel computing platform.

Riskfuel is also a member of NVIDIA Inception, which is a free program for cutting-edge startups. The program provides access to training credits from the NVIDIA Deep Learning Institute, technology assistance, awareness support and opportunities to connect with investors. As a community member,

Speeding Up Sluggish Models

Riskfuel’s first customer happened to be Ferguson’s old employer, Scotiabank. When that work garnered the bank an industry award, the market noticed.

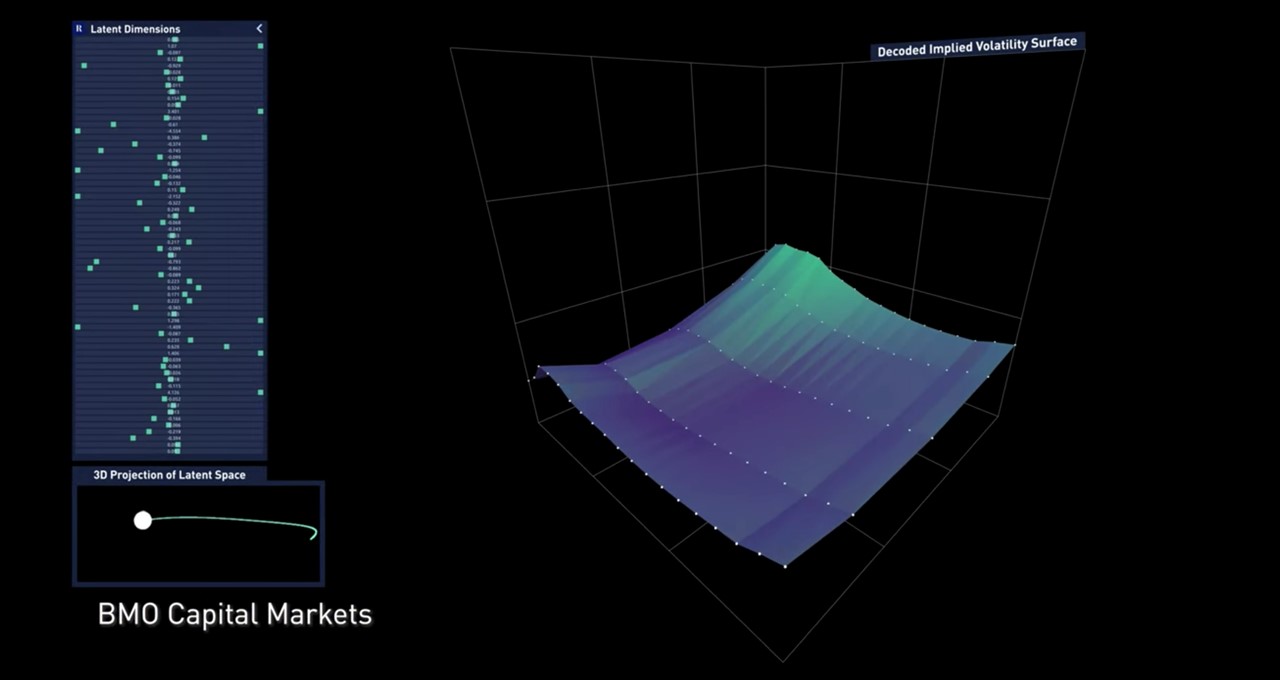

The company then partnered with Bank of Montreal (BMO), which was looking to improve the performance of its CPU-based structured notes models.

BMO employed industry-standard Monte Carlo simulations to process pricing requests, each of which could take several minutes to run on a single CPU core. But that’s too sluggish for the massive quantity of simulations required and the number of deals being run through many risk scenarios every day.

A pilot project showed that versions of BMO models accelerated by Riskfuel and deployed on NVIDIA DGX systems dramatically improved performance. Ultimately, it lets the bank expand its client base, drive higher trade flows, generate new risk insights and lead to better product design and selection.

According to Lucas Caliri, managing director and head of Cross Asset Solutions at BMO, “The partnership with Riskfuel and NVIDIA is enabling us to assist our clients to handle more complex hedging strategies and — with accelerated pricing and analysis — make faster, smarter investment decisions.”

Building a GPU-Powered ‘Rocket’

Riskfuel built its model by training it on 650 million data points, using NVIDIA DGX A100, which Ferguson calls an “AI workhorse.”

The startup works with banks’ code by using their CPU models to create training datasets for neural nets, which run on GPUs using PyTorch, TensorFlow or any other AI library. Then, it delivers its product as packaged neural nets, allowing customers to choose whether to run inference on NVIDIA A100, A30 or other NVIDIA Tensor Core GPUs.

Once the Riskfuel model is in, banks notice a huge speedup, while maintaining the same API for model access.

“We take their car into the garage, rip the engine out and put a rocket in,” said Ferguson. “It looks like the same car, but on the inside, it produces the results way faster.”

Riskfuel’s model sacrifices nothing in the way of accuracy — even with all that speed — no matter how far a bank might push it. Ferguson said that banks no longer have to trade speed for accuracy, or vice versa.

“Historically, there’s basically been a toggle that says faster or more accurate,” Ferguson said. “With Riskfuel, you can get fast and accurate.”

Just the Beginning

Looking forward, Riskfuel hopes to provide solutions for more areas in which banks can’t process scenarios fast enough. For example, previously, banks had to choose which risk scenarios to run, but that limitation is being removed.

“Now that their derivatives portfolio models can run in seconds, banks need real-time data and faster risk scenario generation,” said Ivan Sergienko, chief product officer at Riskfuel. “These are potential growth areas for us.”

Learn more about NVIDIA offerings for the financial services industry.